Understanding Zakat: A Comprehensive Guide for Muslim Families

Zakat constitutes one of the Five Pillars of Islam, functioning as a vital charitable practice that purifies wealth and mitigates the disparity between the affluent and the impoverished. It is an obligation for every eligible Muslim and is seen as a method of spiritual cleansing and societal benefit. This blog will examine the calculation of Zakāh, its applicability, and the reasons for the discrepancies in rulings among various Islamic schools of thought.

What is Zakat?

Zakat a purifier of the property.”

Sahih al-Bukhari » Obligatory Charity Tax (Zakat) – كتاب الزكاة

We went out with ‘Abdullah bin ‘Umar and a bedouin said (to ‘Abdullah), “Tell me about Allah’s saying: “And those who hoard up gold and silver (Al-Kanz – money, gold, silver etc., the Zakat of which has not been paid) and spend it not in the Way of Allah (V.9:34).” Ibn ‘Umar said, “Whoever hoarded them and did not pay the Zakat thereof, then woe to him. But these holy Verses were revealed before the Verses of Zakāh. So when the Verses of Zakāh were revealed, Allah made Zakat a purifier of the property.”

Reference: SAHIH AL BUKHARI 1404 Book 24, Hadith 9,

USC-MSA web English reference Vol.2 Book 24.Hadith487

Zakāh is a mandatory kind of almsgiving that necessitates qualifying Muslims to contribute a fraction of their earnings to the needy. The term “Zakat” denotes “to purify” or “to grow,” indicating that by donating a fraction of one’s income, a Muslim purifies their earnings and soul while fostering economic justice throughout society.

When Does Zakat Apply?

Zakāh becomes mandatory when a Muslim’s wealth surpasses the Nisab level (the minimum wealth required for Zakāh to be applicable) for a whole lunar year. The Nisab is established based on either:

Gold Standard: 85 grams of gold (TBC)

Silver Standard: 595 grams of silver (TBC)

Equally owned by two partners

Sahih al-Bukhari » Obligatory Charity Tax (Zakat) – كتاب الزكاة

Abu Bakr wrote to me what Allah’s Apostle (p.b.u.h) has made compulsory (regarding Zakat) and this was mentioned in it: If a property is equally owned by two partners, they should pay the combined Zakāh and it will be considered that both of them have paid their Zakāh equally.

Reference: SAHIH AL BUKHARI 1451 BOOK 24,HADITH 54

Can we pay Zakat on cryptocurrencies?

Any token or bitcoin bought to resell will always be Zakatable. On one’s Zakāh anniversary, one pays their due on the market value. At the moment of computation, one should translate the value of the cryptocurrencies into their local money.

Should a cryptocurrency not be bought for resale, a coin such Bitcoin, Litecoin, Ripple, Dogecoin, etc. will still be zakatable due of their use as currencies within their ecosystem (they are like cash).

The type of the token and what it stands for will determine Zakāh on tokens not bought to resale.

Allah knows best

What is Nisab?

Before they qualify to pay Zakāh, Muslims must have minimum wealth known as the Nisab. Many times, this value is known as the nisab threshold.

The Nisab threshold is derived from gold and silver values. Comprising 87.48 grams of gold (TBC)or

612.36 grams of silver (TBC), the Nisab is valued.

Current Nisab value (3 March 2025)

Using value of silver 612.36 grams = £487.43 (TBC)

Using value of gold 87.48 grams = £6,403.03 (TBC)

612.36 grams of silver (TBC), the Nisab is valued.

Who Must Pay Zakat?

People who meet the following conditions must pay Zakāh:

Their faith is Islam.

All of them are adults (Baligh).

They have sound mind.

Their wealth is equal to or greater than the Nisab.

A lunar year (Hijri) has passed on their wealth.

How Much Zakat is Due?

The normal rate of Zakat is 2.5% of a person’s wealth that has been above the Nisab level for one lunar year. There are two ways to figure out the Nisab value:

87.48 grams of gold

612.36 grams of silver

Example Calculation:

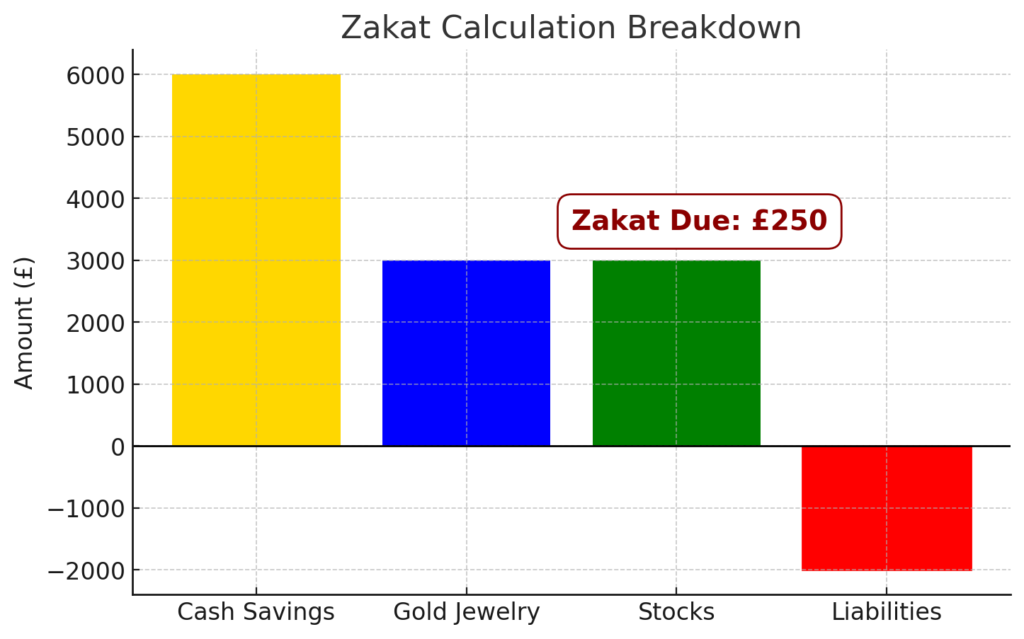

If a family has:

- Cash savings: £6,000

- Gold jewelry: £3,000

- Stocks: £3,000

- Liabilities (debts): £2,000

Total Zakatable wealth = (6,000 + 3,000 + 3,000) – 2,000 = £10,000

If Nisab is £500 (silver-based), Zakāh is applicable, and the amount due is:

£10,000 × 2.5% = £250

Zakāh on less than five camels

Sahih al-Bukhari » Obligatory Charity Tax (Zakat) – كتاب الزكاة

Narrated Abu Sa`id Al-Khudri:

Allah’s Apostle (p.b.u.h) said, “There is no Zakāh on less than five camels and also there is no Zakāh on less than five Awaq (of silver). (5 Awaq = 22 Fransa Riyals of Yemen or 200 Dirhams.) And there is no Zakāh on less than five Awsuq. (A special measure of food-grains, and one Wasq equals 60 Sa’s.) (For gold 20, Dinars i.e. equal to 12 Guinea English. No Zakāh for less than 12 Guinea (English) of gold or for silver less than 22 Fransa Riyals of Yemen.)

Narrated Abi Sa`id Al-Khudri:

I heard the Prophet (p.b.u.h) saying (as above).

Reference: SAHIH AL BUKHARI 1447 BOOK 24, HADITH 50

When is Zakāh Paid?

People usually only pay once a year, after a full lunar year has passed since their wealth hit the Nisab level. Many Muslims choose to pay Zakāh during Ramadan because they believe it will help them spiritually. However, it can be paid whenever it is due.

Differences in Schools of Thought

Hanafi, Maliki, Shafi’i, and Hanbali are the four main schools of Sunni thinking. Each has its own rules about Zakat:

1-Hanafi: Gives you more options for paying Zakāh ahead of time and looks at Nisab based on gold or silver. Property owned by a business and investment income are both subject to Zakat.

2-Maliki: You have to directly own and have full control of your wealth before you can pay Zakat. Malikis don’t count gold worn for personal reasons as Zakāh.

3-Shafi’i: Stresses that each type of income should be counted separately, and jewelry that costs more than the Nisab must be regulated with Zakāh.

4-Hanbali is like Shafi’i, but it is stricter on business inventory, making sure that all assets made for trade are included.

Why Do Differences Exist?

The discrepancies in Zakāh calculations among different schools of thought arise owing to: Differen tassessments of hadiths and Quranic texts.

Contextual distinctions in early Islamic cultures.

Scholarly disagreements on whether assets like jewelry, real estate, and business goods should be included.

Despite these variances, the essential premise remains the same: Zakat is an obligation to cleanse riches and help the less fortunate.

Conclusion

In Islam, zakat is a potent weapon for social justice since it guarantees equitable distribution of wealth and helps people in need. Although different schools of thought may approach computations differently, the fundamental duty stays the same for every Muslim. Muslims not only purify their wealth but also contribute to the establishment of a more equitable society by fulfilling their obligations.